About Cambodia

Cambodia is a country in Southeast Asia that borders the Gulf of Thailand and covers an area of 181,035km2. Neighbouring countries include Laos, Thailand, and Vietnam. The geography of Cambodia is mountainous in the southwest and north and is dominated by the Mekong River and Tonle Sap Lake in the centre of the country.

Phnom Penh is the capital city of Cambodia. Cambodia’s official language is Khmer, and the currency is the riel (KHR).

The government system is a multiparty democracy under a constitutional monarchy; the chief of state is the king, and the head of government is the prime minister.

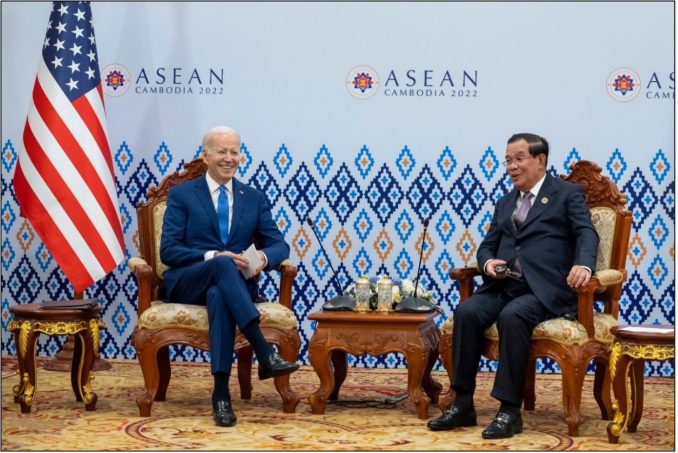

Cambodia gained its independence in 1953 and has a mixed economic system, self-defined as a planned economy with markets, in which the economy includes a variety of private freedom, combined with centralised economic planning and government regulation. Cambodia is a member of the Association of Southeast Asian Nations (ASEAN) and is also a party to the ASEAN-Australia-New Zealand Free Trade Area (AANZFTA), which delivers benefits for Australian businesses in the areas of tariff reduction and elimination, providing greater certainty for service suppliers and investors and supply chain opportunities.

With a youthful population of 16.9 million, vast resources, and its position as one of the poorest members of ASEAN it is poised for growth. Cambodia’s economy grew rapidly, at around 10% per year, between 2004 and 2008. Growth slowed slightly during the global financial crisis in 2008 and 2009 but picked up again to reach a five-year high of 7.6% in 2013. The economy is expected to grow approximately 5.4% in 2022 and 6.6% in 2023.

The continuing increase in economic growth is largely driven by strong exports of garments and agricultural products; expansions of the construction, real estate development, and tourism sectors; and broad-based development in the industrial and service sectors (i.e. hotel and restaurant, financial, transportation, and telecommunication services). It is optimistic that Cambodia will continue attracting more investors because of its low wages, plentiful labour, proximity to Asian raw materials, favourable tax treatment, and the launch of the ASEAN Economic Community in 2015. Also, the government has said opportunities exist for mining bauxite, gold, iron, gems, and particularly hydrocarbons and natural gas. Following explorations carried out during the last few years, hydrocarbon production is expected to be undertaken in the near future.

In Cambodia, there is no discrimination between foreign and domestic investors. There is a favourable fiscal regime for mining with an income tax rate of 30%, 100% foreign-ownership of projects, a 3% royalty (gold), import duty exemptions and a transparent exploration-mining title process. In accordance with applicable laws and regulations, there are also no restrictions for investors on foreign currency convertibility and repatriation.